XENTIS, the integrated, modular investment management solution designed to manage the entire investment lifecycle.

XENTIS OVERVIEW

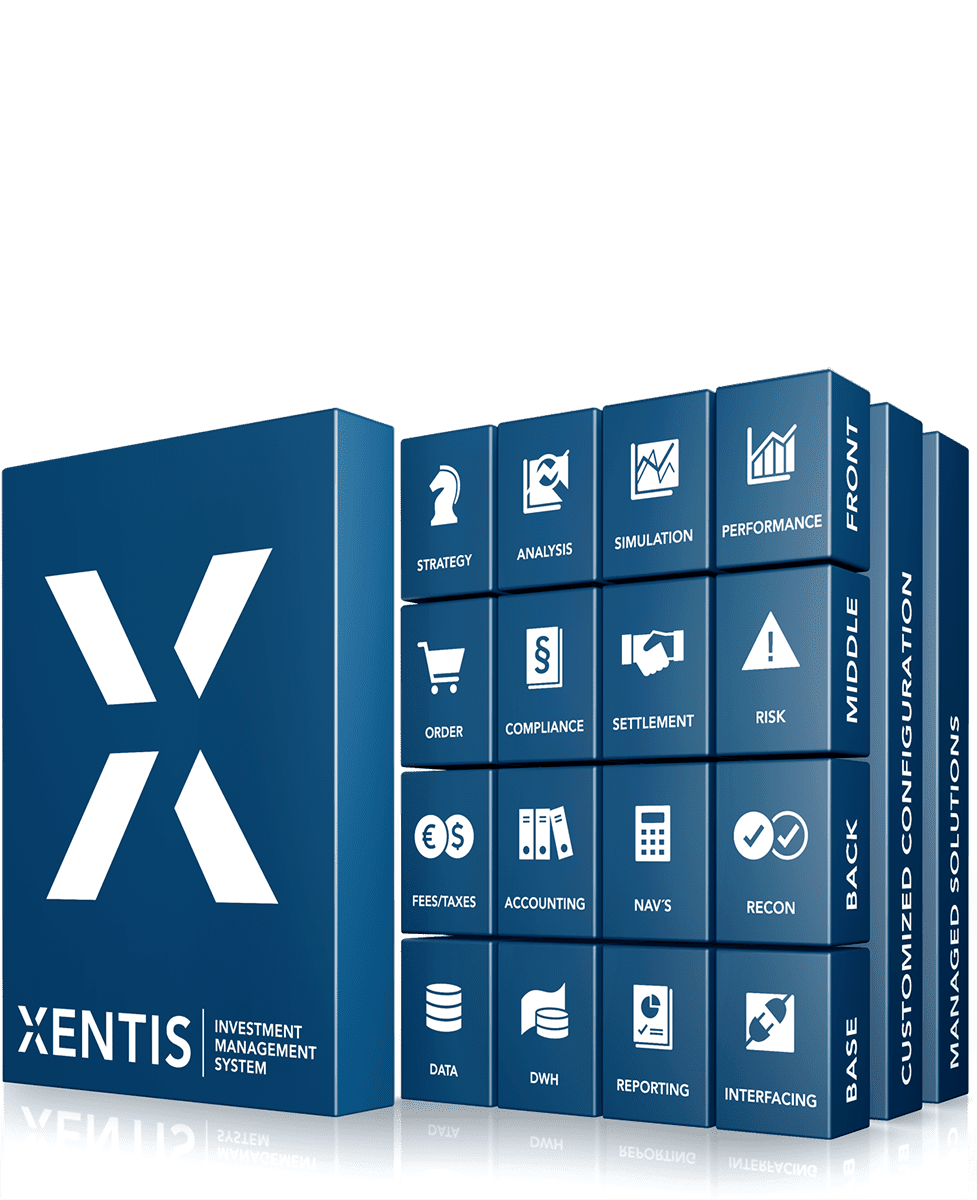

XENTIS is today’s choice for leading investment companies. It is currently used by 5000+ active users to manage assets worth over 4.5 trillion EUR and to price more than 33’000 funds and about 50’000 mandates. XENTIS’ comprehensive functionality fully supports the entire investment process by automating front-, middle- and back-office operations.

There are three options for the implementation of XENTIS:

XENTIS – FRONT-TO-BACK INVESTMENT MANAGEMENT SOLUTION

Exceptional depth and breadth of functionality

XENTIS’ extraordinary scope of functionality meets the highest standards. Its functions are grouped into 16 modules that are fully integrated. The structural concept has two key advantages that differentiate XENTIS from specialised applications: first, all technical business components can be used across all function-modules and second, the availability and consistency of data across all function-modules is achieved through a centralised database.

This ensures data consistency, minimises the system complexity and simplifies configuration and maintenance.

Flexibility as a fundamental concept paired with cutting-edge technology

Market-specific requirements and legal regulations are becoming increasingly complex and change more and more frequently. The exceptional architecture and flexibility of XENTIS facilitate a quick and effective implementation of such changes without software enhancements.

XENTIS is suitable both for smaller institutions and for large installations with hundreds of workstations. Special architectural features include transaction-oriented data processing, configurable financial instruments and transaction types, as well as a complete and permanently accessible history of all system changes.

Moreover, the dataset is infinitely expandable. Newly generated data fields are available to users in all modules as soon as they are created. Customer-specific business rules, workflows and key indicators are very easy to configure and can be used anywhere in the system. This means that day-to-day activities can be handled efficiently at all times, and new business areas can be developed in a very short time-to-market.

XENTIS is internet-enabled and ideal for use in environments with decentralised structures, to support external asset and relationship managers, for example.

Individuality as a standard

XENTIS combines the advantages of standardised software with the convenience of a customised solution.

Due to the separation of configurable system components from the standard product, changes to business rules, workflows and ratios, for example, can be implemented independent of release cycles. Customer-specific settings are not affected by software upgrades.

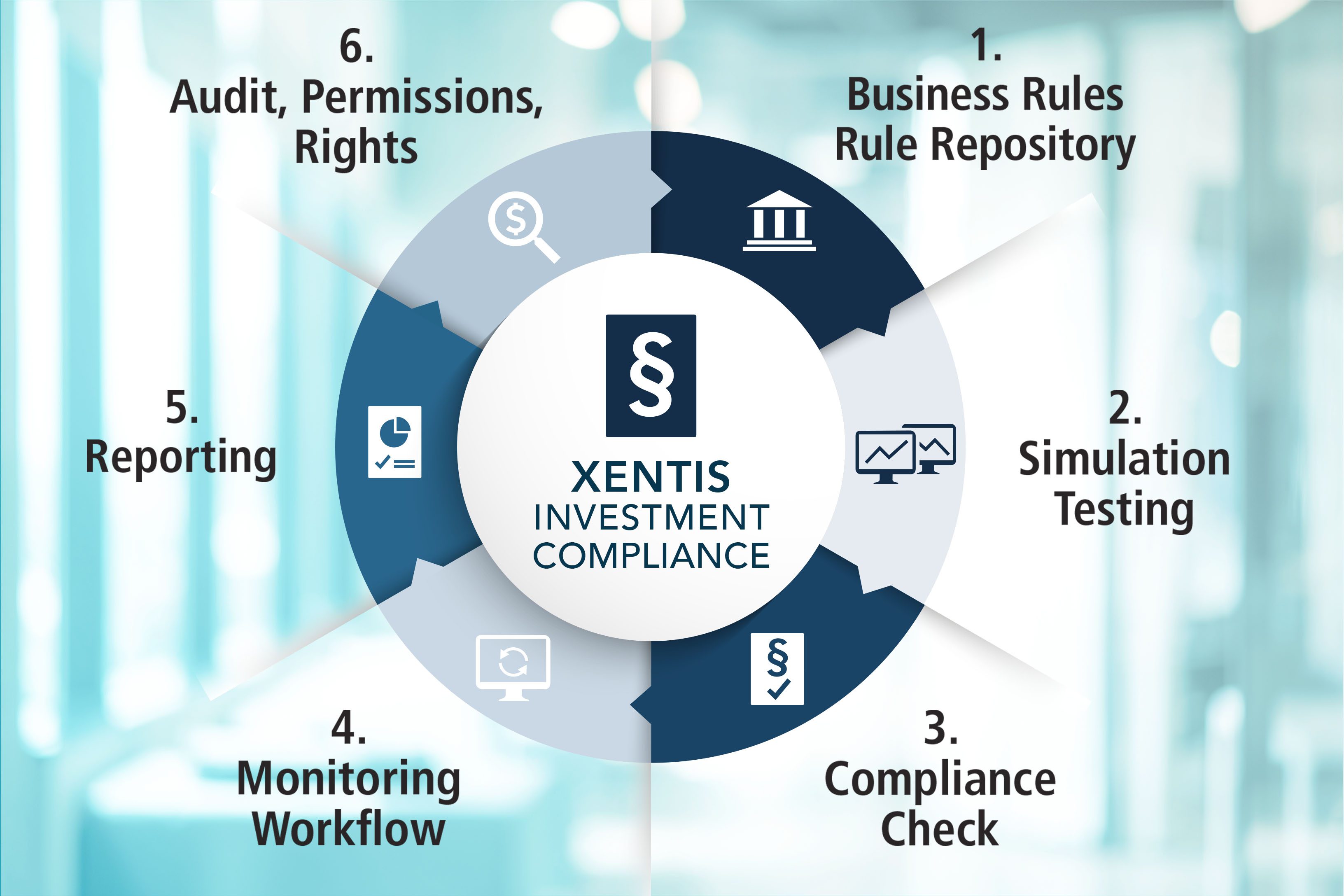

Investment Compliance

Reliable testing of contractual and legal investment limits

the market leader* – integrated or stand-alone, on premise,

hosted or as a service.

- Extensive pre- and post-trade investment compliance functionality

- Defining of limit rules in a standard rule language (business rules)

- Direct testing with productive data, set active on the spot

- Country rule sets for several countries available

- Full process of managing limit violations is controlled with individually configurable workflows

- Differentiation in active and passive limit violations

- Tolerance levels (info, warning, limit, etc.)

- Online check of limit utilisations and violations

- Automated creation of reports including legal notifications

- Look through of composed financial instruments

- Ad hoc and backdated simulation of limit checks

*XENTIS is the preferred solution of institutional fund administrators in Germany

More Information:

![]() XENTIS Investment Compliance

XENTIS Investment Compliance

Portfolio Management

Extensive analysis and simulations to implement your strategies

- Comprehensive range of functions for mandate, fund and portfolio analysis across all asset classes

- Model queries and analysis to suit individual needs

- Target/actual comparisons and preparation of investment proposals

- Order generation incl. pre trade investment compliance

- Investment Book of Record (IBOR), based on the XENTIS position, continuously updated by events such as trades, corporate actions and price changes

- Risk-adjusted performance measurement (contribution and attribution)

- Exposure and overlay analysis

- Cash forecasting and cash flow projection

- Optimisation/hedging

- Excel module with bi-directional data transfer

- Dashboards

Order Management

Real straight-trough processing from order generation to billing

- Straight Through Processing, from generating investment proposals

to executing orders and settling transactions - Parameterised order workflow on a customer-specific basis using

business rules - Trading of all financial instruments

- Pooling and splitting

- Integrated market conformity checks

- Pre-trade investment compliance checks

- Linking of trading platforms such as Bloomberg EMSX,

TSOX und FXGO - Automated or manual multi-level matching

- Real-time update of order and inventory balances after execution

- Event-driven order blotter

Risk Management

Reliable measurement and control of market risks

RiskRadar can work independently as a standalone solution or can act as a solution which is entirely embedded and integrated into XENTIS. In this case, calculations of the risk indicators are based on data that RiskRadar obtains from XENTIS. The resulting key figures are then loaded back into XENTIS and are available for further processing by any XENTIS modules (evaluations, IC checks, reporting, etc.).

Here is a summary of available functionalities

- Calculation of theoretical prices for OTC instruments such as forwards, options, swaps or swaptions

- VaR/Volatility calculation based on factor models and multiple methods (e.g. Monte Carlo method)

- Stress testing

- Concentration risk(e.g. sector risks, credit risks etc.)

- Liquidity risk monitoring (incl. liabilities and stress testing)

- Various asset level risk metrics (contribution to VaR, Fixed Income or derivative metrics etc.)

- PRIIPS SRI and performance scenarios/RIY

Performance Measurement

Transparent analysis of your performance

- IRR, MWR, TWR performance from consolidated portfolios down to single position level

- Contribution and attribution

- System architecture allows for individual components to be included or excluded ad-hoc, for example, performance may be calculated net, gross, or involving a subset of specific fee and cost components

- Performance comparison with simple or composite benchmarks

- Benchmarks can be set as indices or portfolios down to position level or as composite benchmarks

- Performance and risk management modules can take existing and simulated holdings into account

Settlement and Reconciliation

Highly automated processing and coordination processes

- Dispatching of instructions and receipt of confirmations for orders

and transactions are processed in XENTIS via SWIFT, FIX, FAX,

e-mail, etc - Parameterisation is based on Standard Settlement Instructions

- Individual adjustments to the processing data for each order or transaction

- Periodic reconciliation of data between internal and external sources

- Individual reconciliation processes, controlled by means of workflows, definable in XENTIS

- Reconciliation analysis provides extended search capabilities for

individual mismatches - Consolidated display of all results through multiple reconciliation

processes at mandate, fund or instrument level

More Information:

![]() Automated Reconciliation Procedures with variable Parameters

Automated Reconciliation Procedures with variable Parameters

Investment Accounting

Strong booking functionality for a wide range of accounting regulations

- General and sub-ledger function

- Upon a one-time entry of a transaction, holdings can be managed in parallel, accordance with any number of accounting or tax standards, e.g. local GAAPs, IFRS, US-GAAP, etc

- Accounts can be flexibly defined by account class, account group and single account

- Transaction and posting histories are transparent and can be retraced at any time

- Online balance sheet and income statement

- Reversal chain logic

- Valuation on booking, trading and value date

- Multi-currency capability

- Trial balancing runs can be performed across all accounts ad hoc

- End of period and ad hoc closings (fast close)

- Group accounting consolidations

Fund Administration and Fund Accounting

Efficient mapping of all fund structures and processes

- XENTIS covers all fund types (plain vanilla, real estate, derivative, private equity, hedge, strategy, theme, umbrella, fund-of-, multi manager, multi class, master/sub and master/feeder funds)

- Delivery of the Net Asset Value (NAV) via so-called processing cycles is automated and can take place at any point in time

- Working steps may either be an approval or a processing step

- Processing steps execute specific processing cycle functions such as corporate actions, checking the prices/rates applied for fund valuation, investment compliance checks, fee, fund valuation, plausibility and price distribution

- Ensuring a NAV calculation of all fund types

- Definable tax and fund figures

- Booking of special events such as fund mergers, restructurings, etc.

- Annual/semi-annual statement of accounts and legal reporting

More Information:

![]() Fee Handling with Performance-Dependent Remuneration Models

Fee Handling with Performance-Dependent Remuneration Models

![]() Fee Module

Fee Module

![]() Unit Administration for Investors in Institutional Funds

Unit Administration for Investors in Institutional Funds

![]() Externally valuated positions in XENTIS

Externally valuated positions in XENTIS

Alternative Investments & Document Management

Integrates your Private Market Investments into XENTIS

- Seamlessly enhances “Private Equity” and “Private Debt” asset classes within XENTIS

- Comprehensive templates cover private markets instruments, including commitments and cash flows

- All-in-one view simplifies monitoring and visualization of investments and respective key figures (e.g. IRR, TPI, RVPI, DPI)

- Automated mechanism to adjust NAV based on cash flows and retroactive reports

- Position Specific Investment Valuation with GP-specific pricing

- Integration of Document Management system in XENTIS

- Intuitive Document Handling with Drag & drop functionality for inserting, viewing and editing documents within XENTIS

More Information:

Alternative Investments in XENTIS

![]() Alternative Investments in XENTIS

Alternative Investments in XENTIS

![]() Document Management System in XENTIS

Document Management System in XENTIS

Reporting

Diverse standard reports and individual reporting

- Comprehensive range of pre-configured reports

- Client-specific reportings which fall outside the standard

- Standardised production of fact sheets

- High-performance processing of large report volumes for mass reporting

- Query builder provides users with a flexible, easy-to-use tool to generate ad hoc queries in Excel format

- Legal reporting in all market segments

- Reaction in shortest time to market to continuous regulatory changes is possible because the structural components of XENTIS allow for respective configuration

More Information:

![]() Development of AIFMD Report in Shortest Time-to-Market

Development of AIFMD Report in Shortest Time-to-Market

![]() Fund Fact Sheets

Fund Fact Sheets

![]() Liquid Assets Report

Liquid Assets Report

![]() TR notifications in accordance with EMIR in XENTIS

TR notifications in accordance with EMIR in XENTIS

Data structures and integration

Flexible expandable data model

- Data structures are infinitely flexible and extendable

- Linking all modeled data with business rules

- Integrated data warehouse with data marts

- Audit security, historicisation and granular authorization concept

- System-specific user authorisation, multi-client capable

- Highly configurable, yet easy to use integration environment, rapid deployment of input/output interfaces

- Interfacing with numerous data providers (Bloomberg, SIX Financial Information, Thomson-Reuters), general ledgers (SAP), depositary banks, SWIFT, FIX, trading platforms (EMSX, TSOX, FXGO), EMIR trade repositories (REGIS-TR, DTCC) and many other third party applications

Interfaces/Integration

Flexible connection for an efficient networking

- Market – / Security Master data*

- SIX

- Bloomberg

- Reuters

- WM

- ÖWS

- FactSet

- ValPoint

- Interfaces Custodian bank

- Baader Bank AG

- BKS Bank AG

- Bank Julius Baer & Co.Ltd

- Bank of New York Mellon / BNY Mellon

- Bank J. Safra Sarasin AG

- Bank Vontobel AG

- Bankhaus Lampe KG

- Banque de Luxembourg SA, Luxembourg

- BNP Paribas

- Banque SYZ SA

- Barclays Bank plc

- Bayrische Landesbank

- Berenberg Bank

- Berner Kantonalbank

- Blackrock Financial Management Inc.

- Brown Brothers Harriman & Co

- Caceis Bank Deutschland Gmbh

- Citibank

- Commerzbank AG

- Compagnie Financière Edmond de Rothschild

- Crédit Agricole CIB

- Credit Suisse AG

- Daiwa Asset Management Europe Ltd

- Danske Bank

- Degussa Bank Gmbh

- Deutsche Apotheker- und Ärztebank

- Deutsche Bank AG

- DGZ Dekabank, Deutsche Kommunalbank

- Euroclear

- Goldman Sachs

- Hamburger Sparkasse AG

- Hauck & Aufhäuser

- HSBC Trinkaus & Burkhardt AG

- J.P. Morgan & CO

- KAS BANK

- Kreissparkasse Köln

- Kreissparkasse Saarpfalz

- Landesbank Baden-Württemberg

- LGT Bank

- Lombard Odier

- M.M. Warburg & Co

- Macquarie Bank Ltd

- MainFirst Bank

- Merck, Finck Und Co

- Merrill Lynch International Bank Ltd

- B. Metzler seel. Sohn & Co. (Kommanditgesellschaft auf Aktien)

- Morgan Stanley International Limited

- Northern Trust London

- Oddo BHF

- Pictet Group

- Raiffeisen Capital Management

- Schroder Investment Management (PLC)

- Skandinavische Privatbank (SEB)

- Sparkasse Fulda

- Sparkasse Harburg-Buxtehude

- State Street

- Unicredit Bank AG

- Hypo Vorarlberg Bank AG

- VR Bank Fulda eG

- Zürcher Kantonalbank

- Broker / trading platforms

- Bloomberg EMSX

- Bloomberg EMSXNET

- Bloomberg TSOX

- Bloomberg FXGO

- Hauck & Aufhäuser

- Berner Kantonalbank

- Credit Suisse

- J.P. Morgan

- Baader Bank

- Bank of America Merrill Lynch

- BNP Paribas

- Landesbank Baden-Württemberg

- Barclay’s BARX

- Berenberg Privatbank Berlin

- UBS Deutschland

- Hauck & Aufhäuser

- Morgan Stanley

- Tradeweb

- HSBC

- Steubing AG, Wertpapierhandelsbank

- MarketAxess

- Core banking system

- Avaloq

- Olympic (Firma ERI)

- banqpro (core banking)

- Real estate system

- Immopac AG

- Streets Crossing TECH

*Formate:

FIX, Swift, Excel, CSV, XML, BVI

CONTACT

Dr. Frank Jenner

Business Development & Marketing

Member of the Management Board

+41 44 736 47 47

sales(at)profidata.com

Gunther Glabbatz

Business Development

Germany & Austria

+49 69 297 28 95-0

sales(at)profidata.com